Bitcoin: Retail Buys While Sharks Cash Out

A Targen Insights analysis.

In financial markets, particularly in the cryptocurrency segment, understanding investment dynamics can be crucial for effective decision-making.

A recurring phenomenon in the Bitcoin market clearly illustrates these dynamics: while large-scale investors, known as “sharks,” seize strategic moments to take profits, retail investors exhibit a paradoxical behavior of intensifying their purchases even in the face of significant price drops.

This article aims to explore this behavior, focusing on the recent period following Bitcoin’s latest all-time high, during which the asset experienced an approximate 10% correction.

Market Overview: Sharks Take Profits, Retail Intensifies Purchases

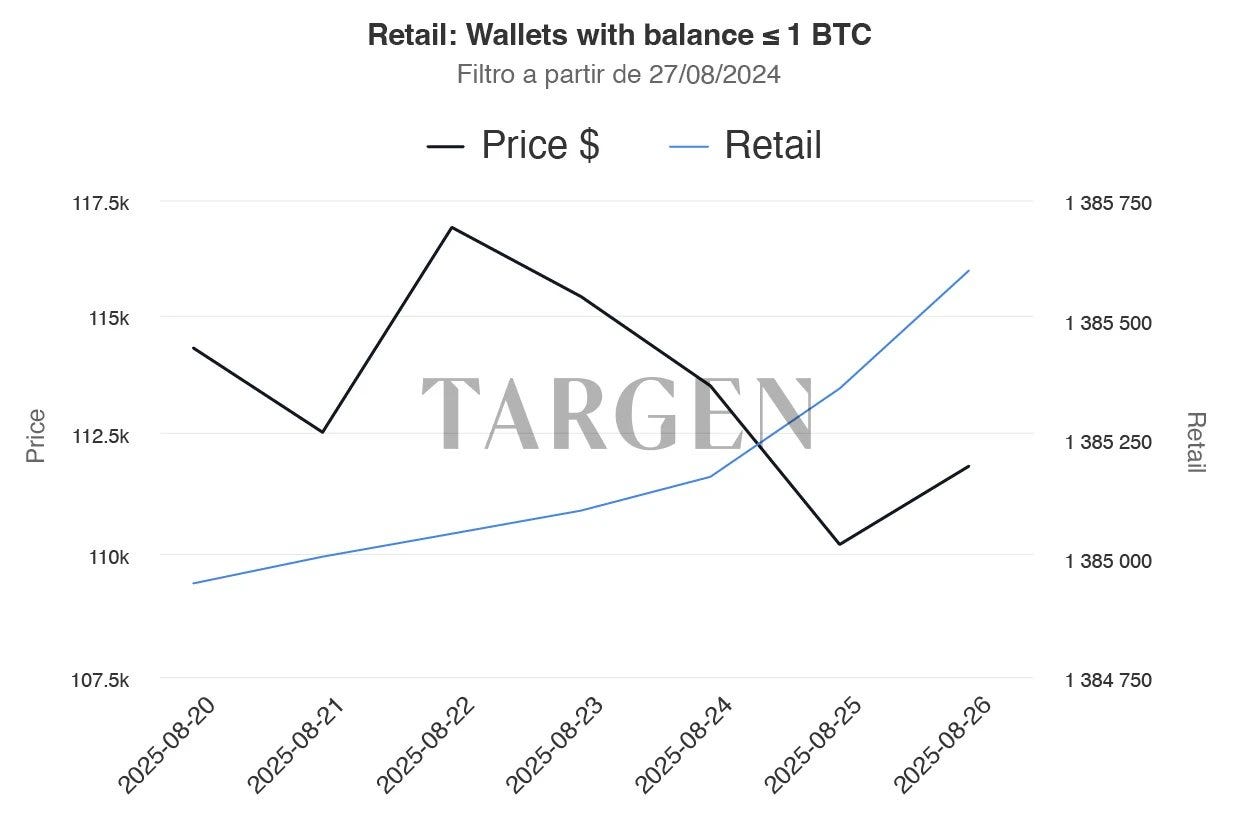

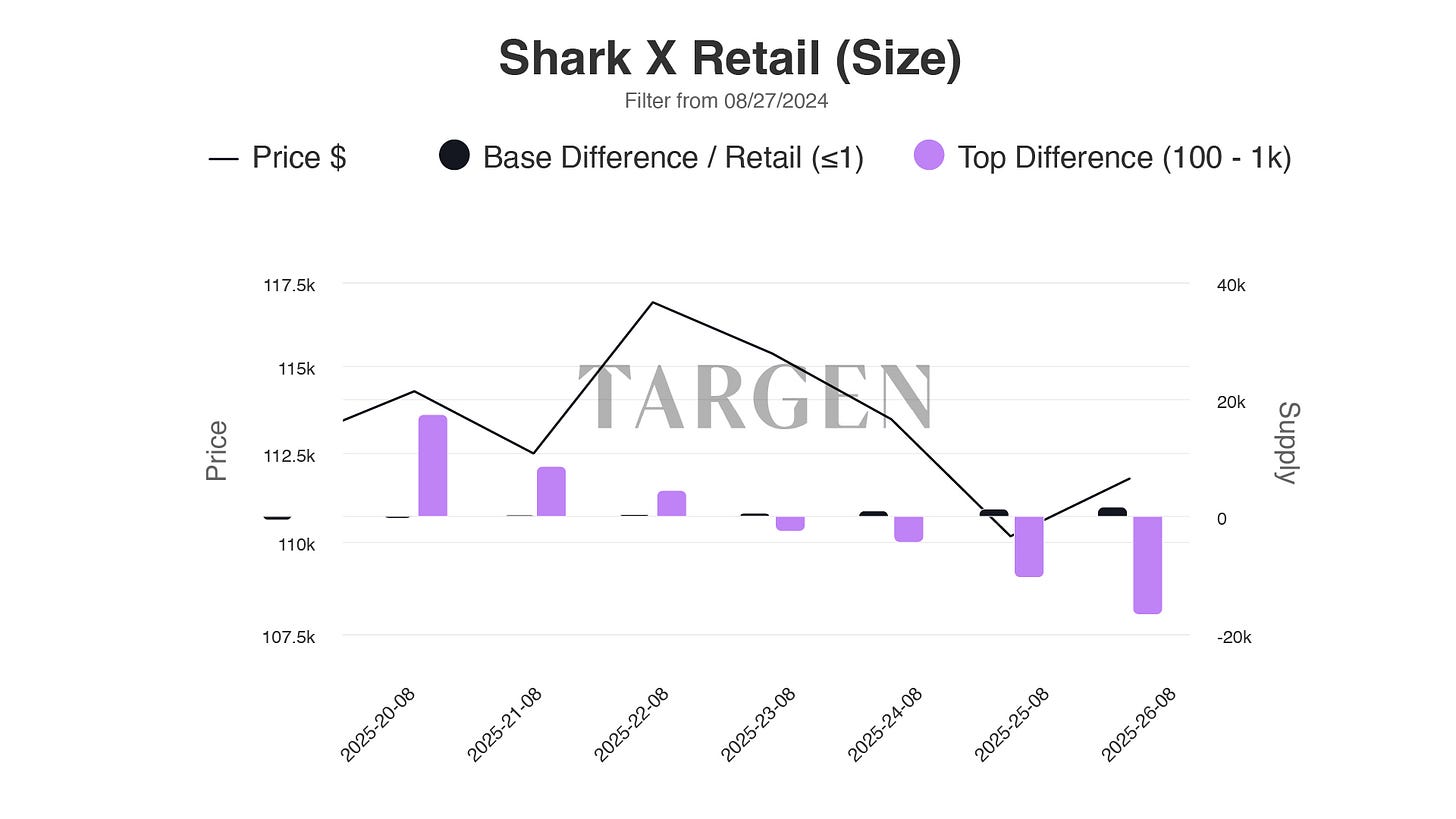

Since the Bitcoin market reached its latest peak, the price has undergone a roughly 10% retracement. During this correction, wallets classified as sharks—those holding between 100 and 1,000 BTC—opted to realize profits. This strategic move demonstrates their ability to capitalize on market fluctuations to maximize gains and reduce exposure risks.

In contrast, retail investors—those with wallets holding up to 1 BTC—have significantly increased their purchases during the same period of decline and high volatility. This pattern highlights a different approach, often less aligned with professional investment strategies.

Understanding Retail Behavior

Retail behavior is frequently analyzed through the lens of bounded rationality. Unlike sharks, who have access to more robust information and develop strategies based on technical and fundamental analysis, retail investors tend to respond to Bitcoin market movements in a more emotional and less informed manner.

This delayed response to significant changes, especially during periods of high volatility, leads many retail investors to buy at elevated price levels, driven by a combination of optimism and psychological fear.

The Role of FOMO in Retail Investor Behavior

A key concept for understanding the observed retail behavior is FOMO (Fear of Missing Out). This psychological phenomenon drives investors to acquire assets after significant price appreciation, motivated by the fear of missing a seemingly unique opportunity.

In the context of the Bitcoin market, FOMO creates a scenario where retail investors buy at highs, often at short-term peaks, exposing themselves to subsequent market corrections. This behavior can result in losses that negatively impact future investment appetite and long-term wealth-building.

Shark Strategies: Profits Realized at Opportune Moments

In contrast, sharks employ profit-taking strategies that account for the asset’s volatility and Bitcoin market dynamics. By selling at elevated levels, these large investors protect their gains, minimize the impact of corrections, and reallocate their portfolios to optimize risks and opportunities.

This contrast between profit-takers and recurring buyers during price declines underscores the importance of timing and discipline in Bitcoin investment management. The ability to avoid panic or euphoria and act based on structured analysis is a defining trait of institutional and professional investors.

Implications for Individual Investors

For individual investors, understanding this dynamic is essential to avoid common pitfalls in the Bitcoin market. The surge in retail buying amid price declines may be interpreted as a sign of overconfidence or a reflection of FOMO, both of which require careful attention.

Investing driven solely by emotion and without a clear strategy can lead to unnecessary risk exposure and compromise an investor’s financial sustainability. In this regard, adopting risk management practices, technical and fundamental analysis, and, above all, continuous education about the market is recommended.

Final Considerations and a Call for Reflection

The current retail behavior in the face of Bitcoin’s price decline serves as an invitation to reflect on investment practices. While sharks adjust their positions to preserve and grow capital, retail investors show a propensity to react emotionally, taking on risks that could be mitigated through more rational strategies.

For professionals and investors seeking to operate more effectively in the Bitcoin market, internalizing this knowledge and investing in analytical and disciplined capabilities is crucial. The cryptocurrency market is promising but demands respect for its unique characteristics and volatility.

excelente