Bitcoin Retail Investors Keep Buying Tops, Selling Bottoms — and Paying the Price

A Targen Insights Analysis

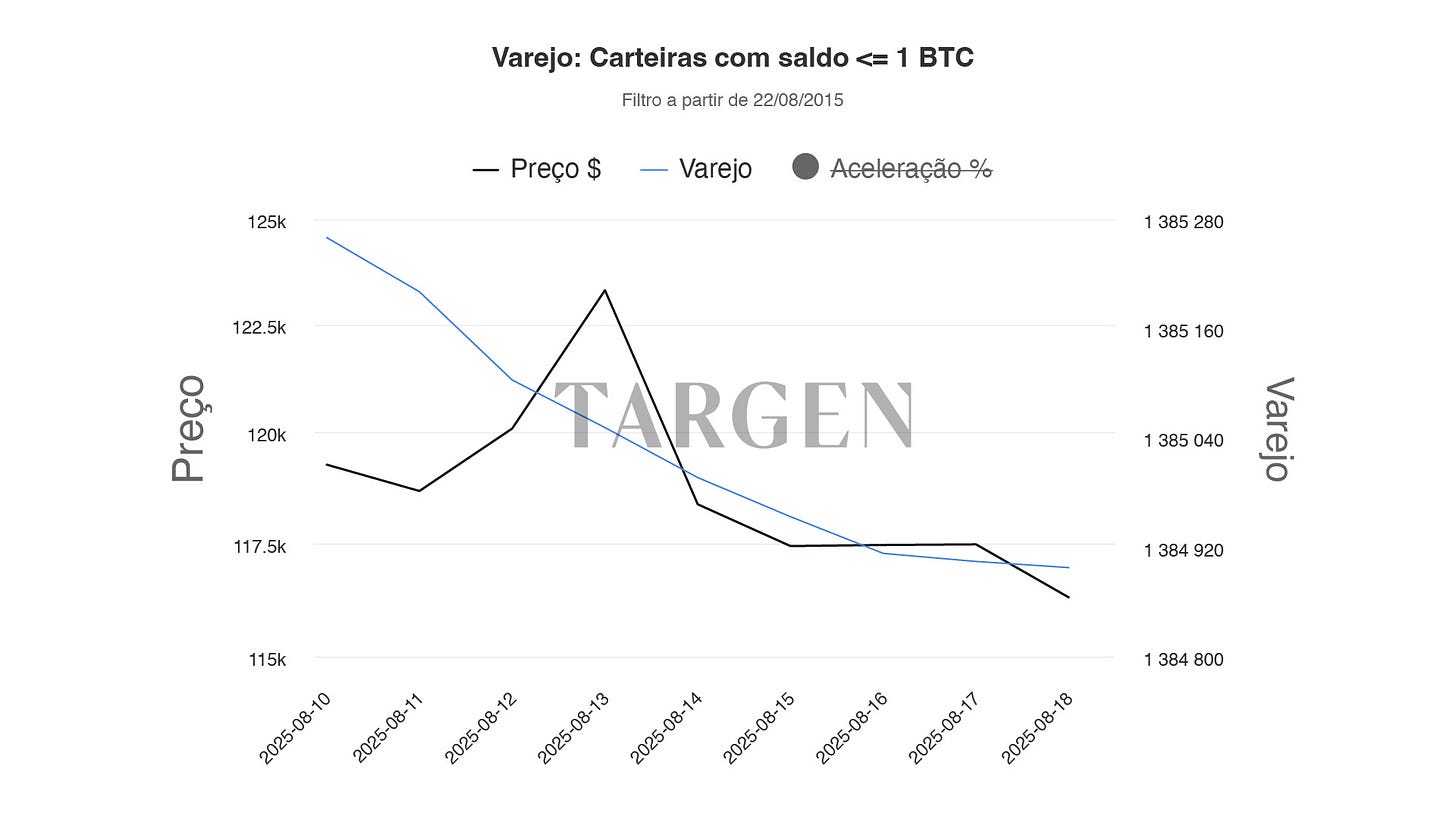

Retail investors remain one of the strongest drivers of volatility in Bitcoin markets — often to their own detriment. In the latest swing, on August 13, 2025, Bitcoin touched a local high of $123,313. What followed was a familiar pattern: small-scale investors chased the rally late, then rushed to the exits as prices started to correct.

A Predictable Retail Playbook

On-chain data show that wallets holding up to 1 BTC did not meaningfully increase exposure before the surge. Instead, the inflows came after the rally had peaked, when upside momentum was already fading.

Ahead of the rally: Minimal accumulation

Post-peak: Retail demand accelerated as prices rolled over

This “buy high, sell low” cycle has long undermined retail performance in crypto markets, amplifying both risks and drawdowns.

Fear and FOMO: Emotion Over Analysis

As the market pulled back, retail traders began liquidating positions in lockstep with falling prices. That behavior reflects emotional trading — FOMO on the way up, fear on the way down — rather than disciplined, data-driven decision-making.

The consequences are costly:

Losses locked in by selling into weakness

Missed upside by exiting too early during potential recoveries

Breaking the Cycle

For investors looking to escape the retail trap, three practices stand out:

Structured Entry and Exit Plans

Rely on technical signals, fundamental drivers, and risk frameworks instead of gut reactions.Dependable Market Indicators

Use tools that anticipate shifts, reducing the urge to chase momentum or panic sell.Ongoing Education

A consistent investment framework builds conviction and prevents costly missteps.

The Bottom Line

Retail participation in Bitcoin continues to mirror a familiar pattern: chasing tops, dumping bottoms. For those seeking better outcomes, discipline and strategy matter far more than emotion. Informed decisions, rigorous planning, and emotional control are the cornerstones of long-term success in crypto markets.

To learn more about navigating digital assets with professional guidance, subscribe to Targen's Substack and see how expert insight can sharpen your financial edge.