Ecoinometrics got it wrong: ETFs don’t drive the Bitcoin cycle

Here's why...

This article was written to the sound of Sibelius.

A new argument has begun to surface. For many years, the Halving was considered by everyone to be the great engine behind Bitcoin’s cycles: X months after the block reward was cut in half, Bitcoin should reach its price peak. However, in 2025 this narrative seems to have broken down – as was to be expected.

The truth is that today, the Halving no longer has a direct causal relationship with Bitcoin’s price appreciation. Various statistical tests make this clear, as does the simple search for explanatory factors. There is correlation, but not causation.

With the collapse of that pattern, other theories have started to emerge. One of them claims that Global M2 is the main driver of Bitcoin’s cycles. Once again, this is a statement lacking logical and statistical validity, as we demonstrate in this article.

Alongside it comes the theory that Bitcoin ETFs are the new price driver. The mistake made by Ecoinometrics in asserting this, in their article “From Halving to Liquidity: Bitcoin’s New Market Cycle”, is the same mistake they make when claiming that Global M2 is a determining force.

In this article, we will dive deeper into the causal relationship between the growth in ETF reserves and the increase in Bitcoin’s price.

The Core Argument

We will not reproduce the paid charts from Ecoinometrics, but we can share a few quotes below:

“... each major wave of ETF inflows has pushed Bitcoin to new highs.”

Here, they clearly draw a cause-and-effect relationship between ETF inflows and new highs in Bitcoin. In other words: they say that the increase in ETF balances causes Bitcoin’s price to rise.

“Bitcoin's big moves once came from whales trading in size or from acute FOMO and FUD during past bull markets. But since the launch of the ETFs, flows have become the key driver, their dynamics now define where you are in the cycle.”

In this passage, they make it clear that this is now the new structure of the Bitcoin cycle. It is not just one factor among many, but the key that defines where we are in the cycle.

“This is where the real cycle dynamics now reside. ETF flows provide direct, real-time information that investors can use for tactical positioning.”

Finally, they emphasize that, since this is public information, every investor can benefit from monitoring ETF reserves.

In summary, according to Ecoinometrics, ETF flows:

cause Bitcoin price variations

determine the Bitcoin cycle

are a public informational edge available to any investor

Ecoinometrics, however, presents no statistical validation for these claims. Now, let’s examine whether they truly hold up — or if they are nothing more than coincidences.

What Came First, the Chicken or the Egg?

The first investigation to be made is quite simple. What happens first: do ETFs buy large amounts of Bitcoin and then the price rises, or does the price rise first and only then do ETFs follow with their purchases?

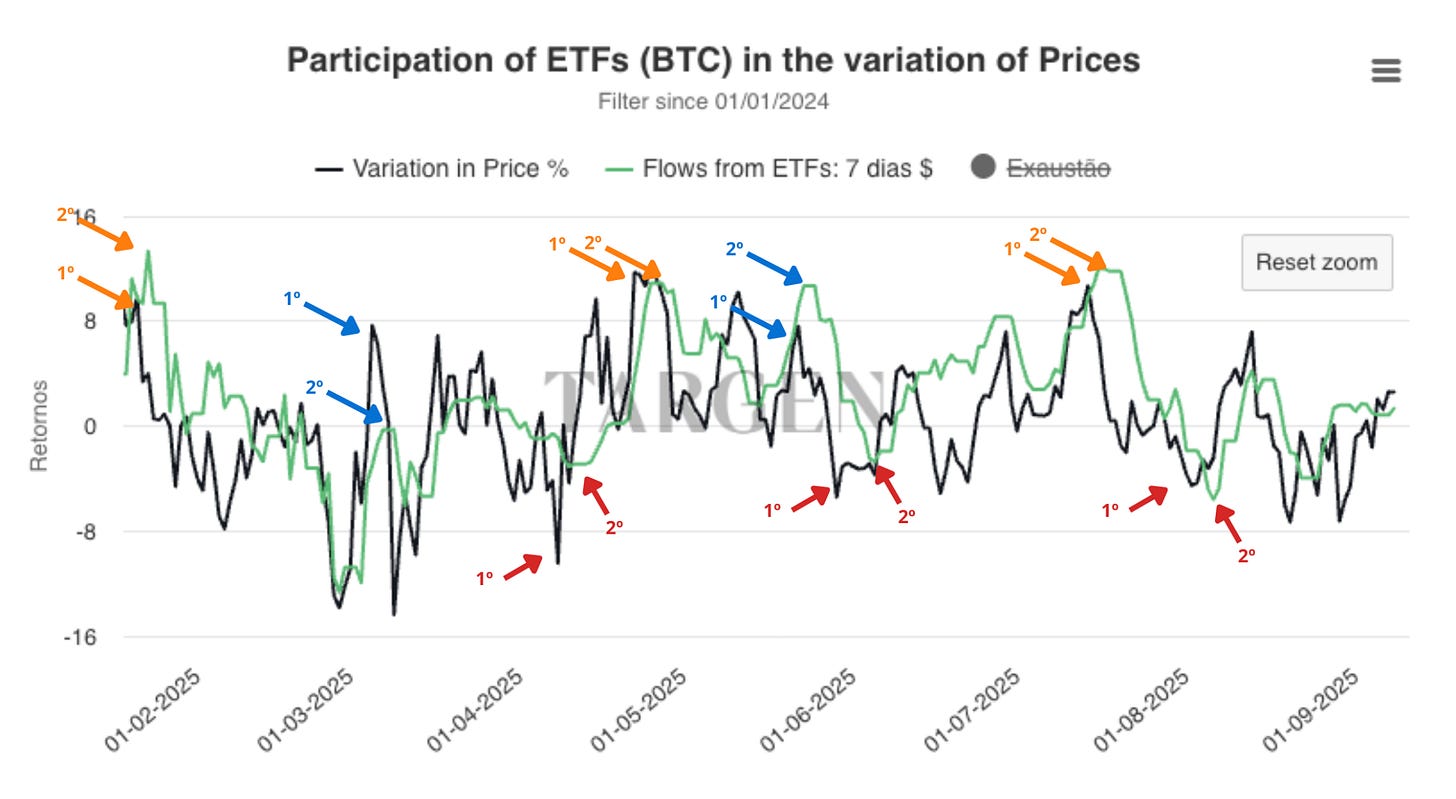

In a purely visual analysis, it becomes clear that, in most cases, ETFs merely follow Bitcoin’s moves with a slight delay, rather than anticipating them.

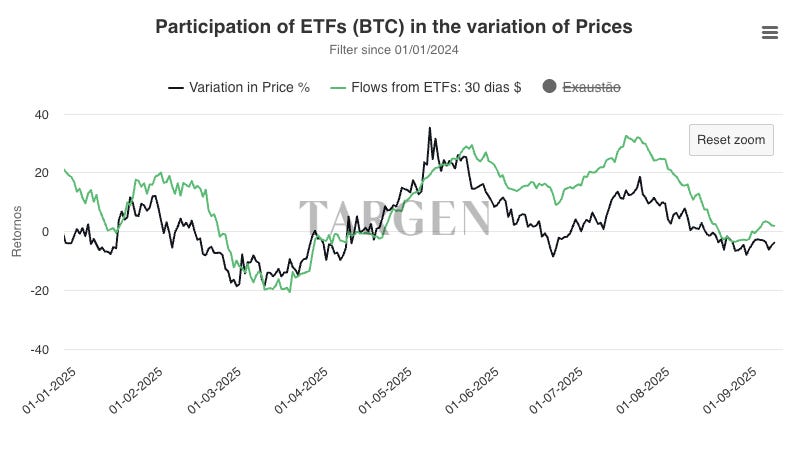

Now, looking at the 30-day average:

While the two datasets often move side by side, in many of the reversals Bitcoin’s price changes trajectory before ETF flows do.

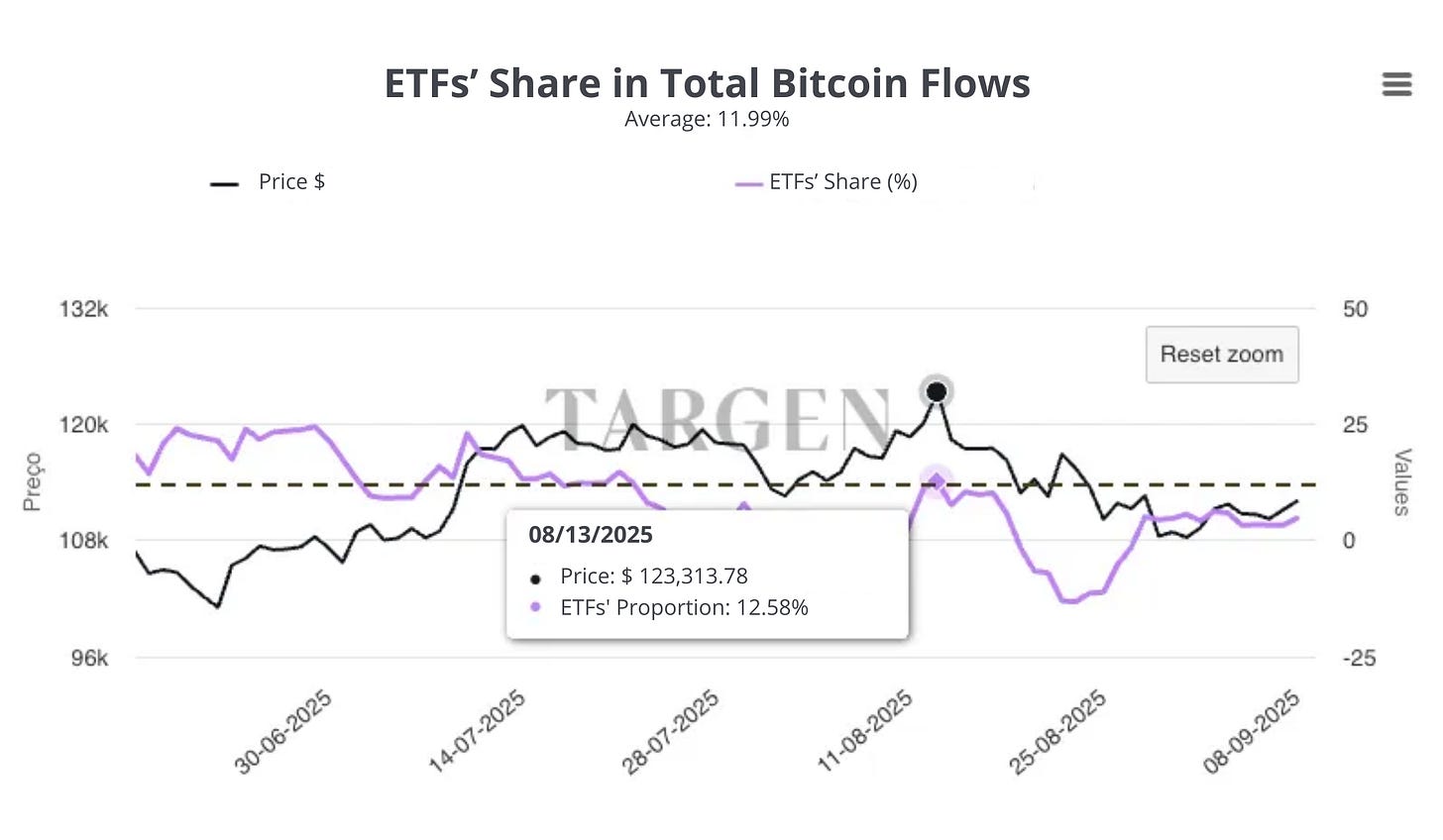

The share of ETFs in the total Bitcoin flow also sheds significant light on the matter.

During the rally that pushed Bitcoin to its all-time high in August 2025, ETFs accounted for around 12% of all Bitcoin purchases. Less than 30 days later, their share had already dropped to under 5%.

How can the so-called “engine” of the cycle be responsible for less than 5% of purchases — and even at moments of strong upward moves, hold only 12% relevance?

Looking at this, it becomes clear that we need to dig deeper if we want to truly understand the relationship between ETFs and Bitcoin’s price. This time, using statistics.

Statistical Evidence

1. Linear Regression

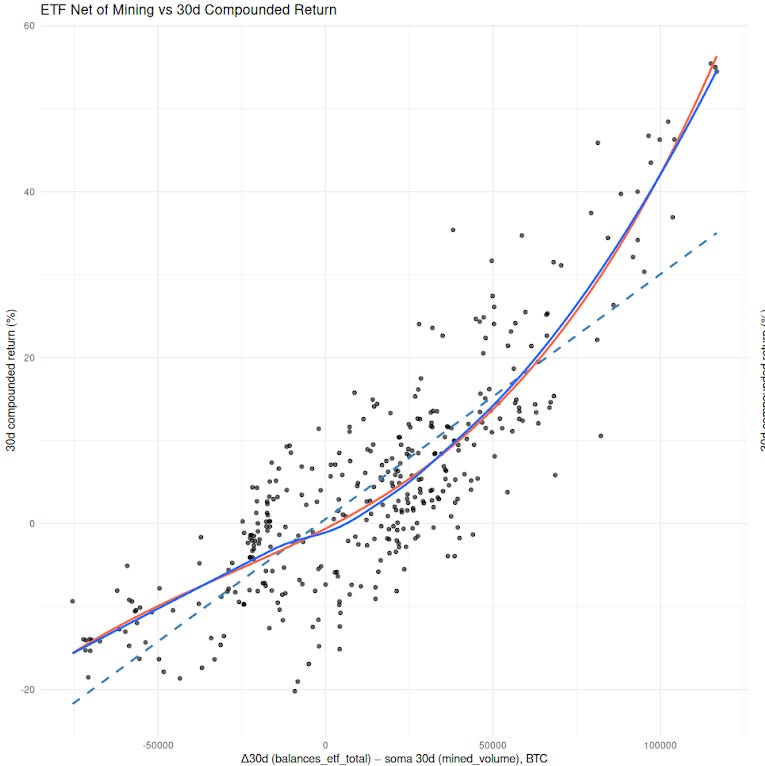

The first chart stands out: when we look at the net flows of Bitcoin ETFs (adjusted for new BTC issuance) and 30-day returns, the curve is clear. Price increases move in step with rising ETF flows.

At first glance, this seems obvious: ETFs would be “pulling” the price upward. But this kind of chart shows only correlation and doesn’t tell us what comes first. Do ETFs actually drive the price, or does a rising price attract new investors into ETFs, as we saw in the previous section?

2. Granger Causality

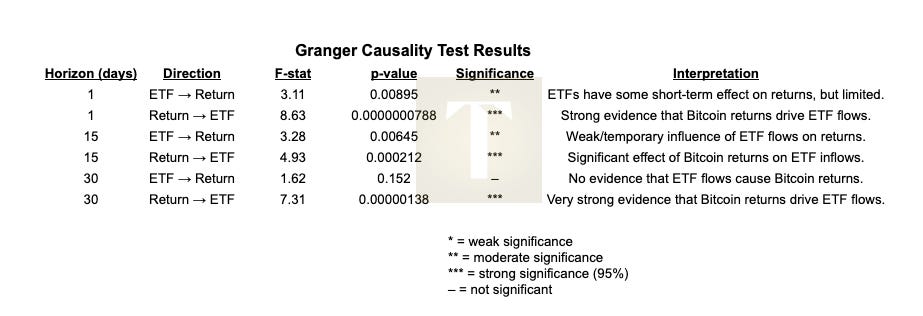

To answer this question, we used a method called Granger causality. It tests whether one variable can consistently predict the other. Given the delay between purchases and public disclosure, we shifted ETF data forward by two days to simulate whether this difference would affect the test.

And the results are clear:

ETF flows do have some effect on price, but it is weak and short-lived.

Bitcoin returns, on the other hand, have a strong and consistent effect on ETF inflows.

In other words: when Bitcoin goes up, ETFs attract new money; when it goes down, inflows shrink. Price comes first—not the other way around (with 95% confidence).

3. Impulse Response Function

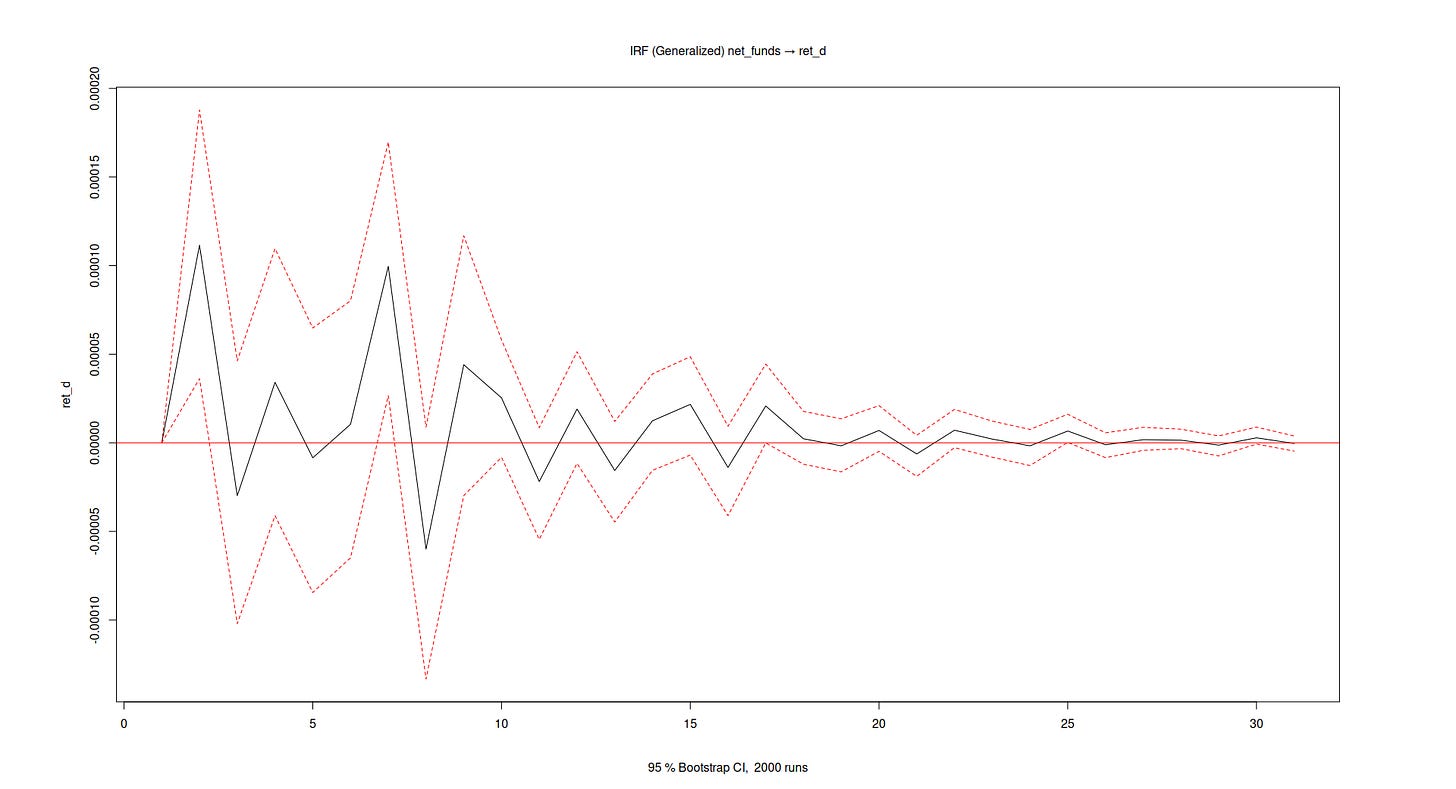

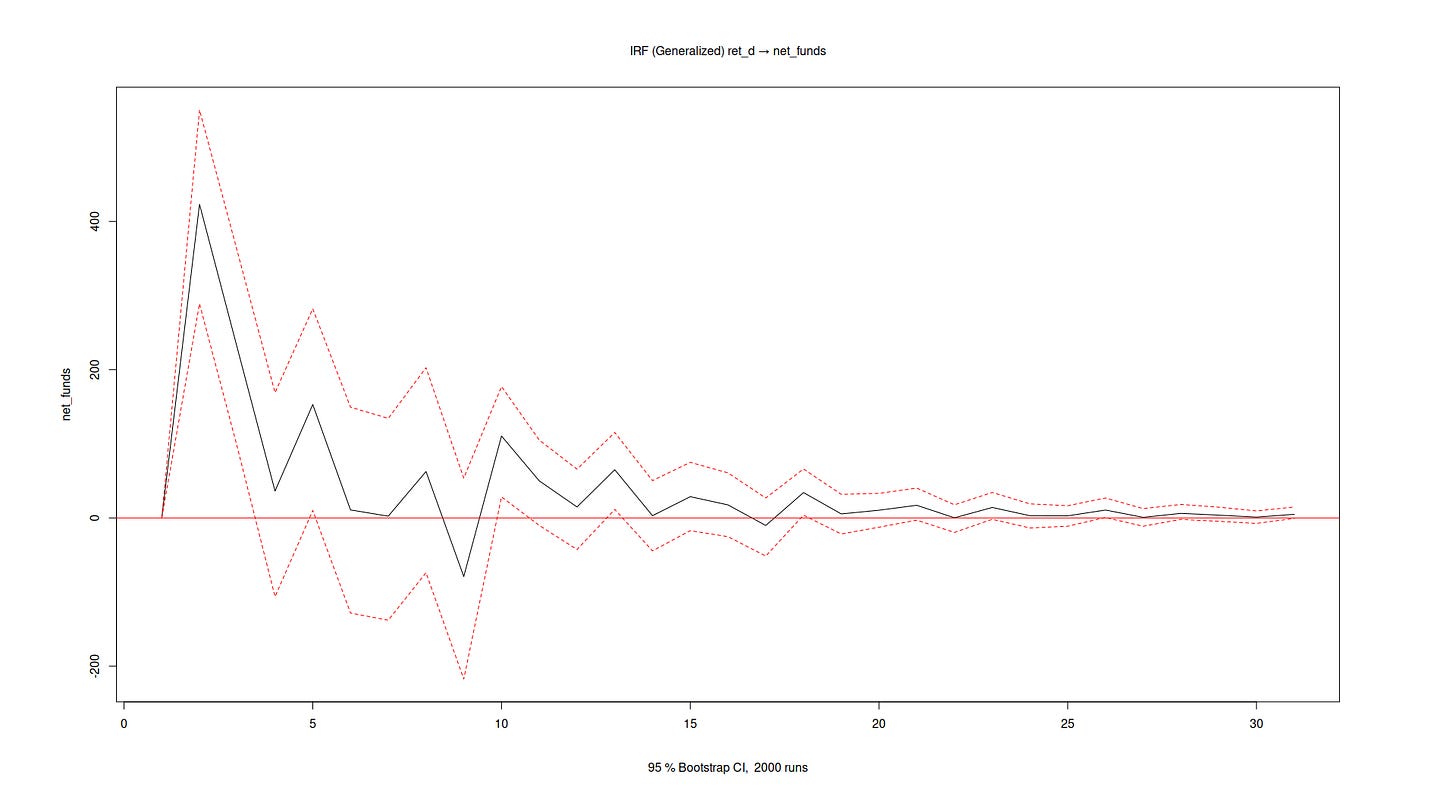

The next two charts reinforce this interpretation. They measure what happens when there is a “shock” in one of the variables.

If ETF flows suddenly increase, the impact on Bitcoin’s price is nearly zero and fades quickly:

By contrast, if Bitcoin’s price surges, we see an immediate reaction in ETF inflows, which then gradually dissipates over the following weeks:

Conclusion

In the cryptoassets market, public information such as ETF flows rarely constitutes a sustainable competitive advantage, since it is available to all investors at the same time and is therefore quickly priced in. In an increasingly professionalized environment — where large asset managers, quantitative funds, and institutional traders operate with advanced tools — the mere observation of open data does not guarantee a strategic edge.

The true value lies in transforming this information into more sophisticated technical insights, combining on-chain analysis, statistical modeling, macroeconomic cycle reading, and interpretations of network behavior. The competitive edge is not in accessing raw data, but in the ability to structure models, identify hidden relationships, and anticipate moves that the broader market has not yet priced in.

So far, it is clear that ETFs are not the engine creating trends in Bitcoin. They act more like an amplifying mirror: reinforcing moves already underway in the market. When the price rises, they attract institutional capital; when it falls, they lose inflows.

This may change over time, no doubt. But for now, the message is clear: ETFs follow Bitcoin, not the other way around.