Ethereum ETFs: A Deep Dive Into Outflows Amid the Token’s All Time High

Just days ago, Ethereum (ETH) shattered records, climbing to a new all-time high of $4,956. The milestone once again cemented ETH as the backbone of decentralized finance and the smart-contract economy.

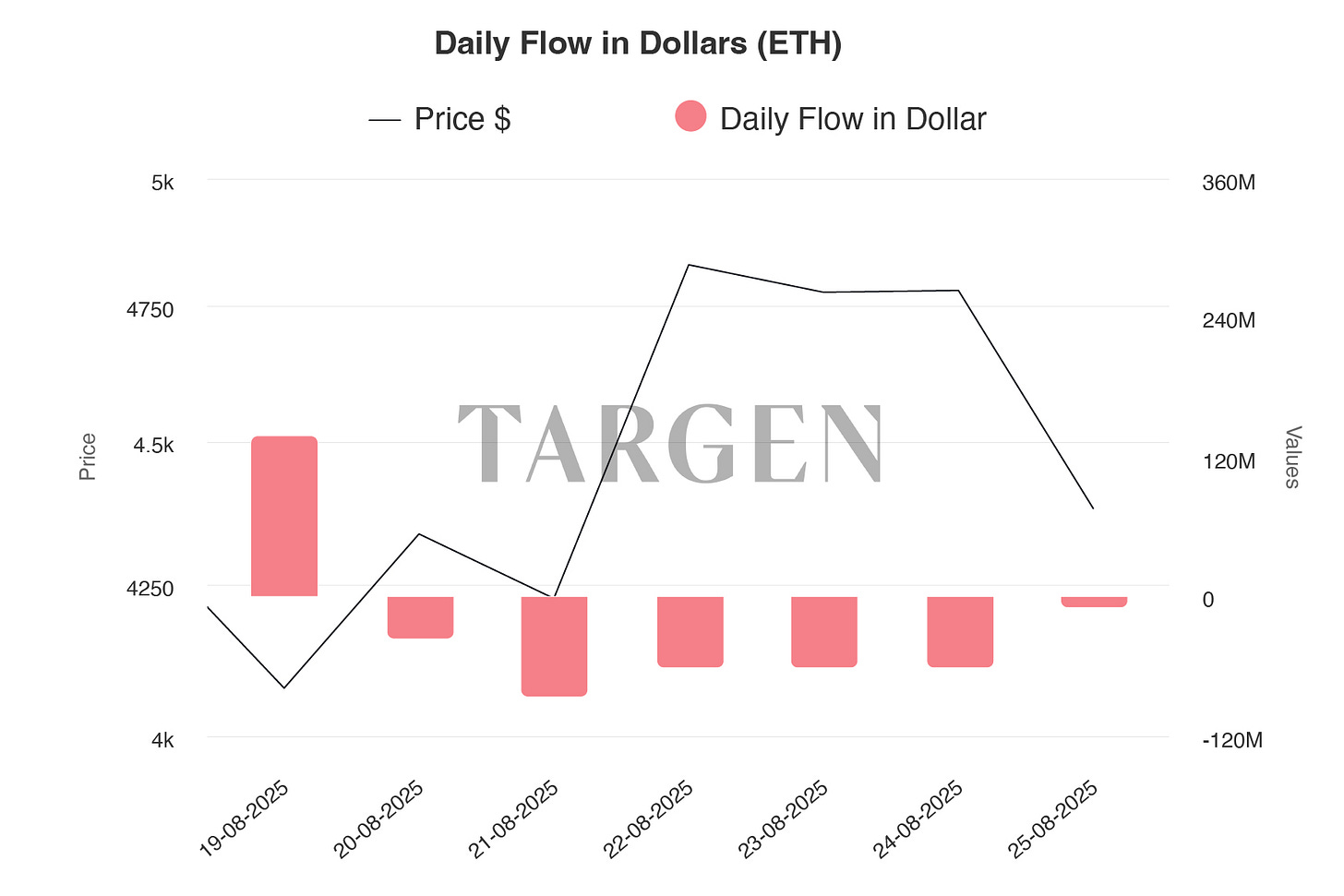

But while headlines celebrated the rally, a very different story was unfolding behind the scenes. Instead of chasing the surge, Ethereum ETFs bled nearly $60 million in outflows — a sharp retreat that began even before the token touched its peak.

That disconnect raises a pressing question: are ETFs truly shaping Ethereum’s market, or is their influence far more limited than investors assume? In the sections ahead, we’ll unpack what drove these outflows, why they mattered during ETH’s historic run, and what the split between ETF investors and crypto-native buyers means for the road ahead.

Understanding Ethereum ETFs and Their Market Role

An exchange-traded fund (ETF) is designed to mirror the performance of an underlying asset or basket of assets. For Ethereum, ETFs provide exposure without the operational hurdles of holding the token directly — simplifying custody, compliance, and execution.

With institutional participation in digital assets steadily rising, ETFs are often seen as a bellwether for mainstream adoption. Large inflows or redemptions are typically assumed to translate into corresponding buying or selling pressure, influencing the spot price of the underlying crypto.

The $60 Million Exodus

The $60 million in outflows logged by Ethereum ETFs ahead of the token’s price surge is striking. In typical bull runs, one would expect inflows, signaling stronger investor appetite. Instead, ETF holders opted to take profits, trimming exposure before ETH broke to record highs.

This suggests a clear divide between ETF investors and those operating directly in the spot or derivatives markets. ETF participants, likely governed by more conservative mandates, may have locked in gains, while retail traders and crypto-native institutions drove the rally with fresh demand.

Equally important: the rally unfolded largely without ETF participation. Secondary-market activity, alongside natural supply-demand dynamics among traders and long-term holders, carried ETH higher.

Limited ETF Impact on Price Discovery

The disconnect between ETF flows and ETH’s price performance underscores a key point — Ethereum’s market is still not dominated by ETF activity. Despite expectations that ETFs might serve as primary price movers, ETH remains influenced more heavily by adoption trends, protocol development, and large crypto-holder positioning.

Crypto’s inherent volatility further dilutes the effect of ETF flows, especially given the relatively small share ETFs represent in overall ETH trading volumes. Broader macroeconomic drivers, shifting regulatory stances, and blockchain-specific innovations continue to shape price action in ways ETFs alone cannot.

Implications for Investors

For professional investors, the ETF outflows during a historic price run are a telling datapoint. They suggest that institutional adoption, while growing, remains uneven — and that retail and direct institutional flows are still the dominant forces in Ethereum’s market.

This dynamic also serves as a caution: ETFs are not yet reliable proxies for gauging ETH’s trajectory. Regulatory complexity, custody considerations, and external liquidity constraints likely continue to temper ETF allocations relative to direct exposure.

For fund managers, the lesson is clear — ETF flows must be analyzed in tandem with broader market indicators to avoid over-reliance on signals from a still-nascent product set.

The Road Ahead for Ethereum ETFs

While Ethereum ETFs currently play a secondary role in price discovery, their potential remains substantial. As regulatory frameworks mature and institutional trust in crypto assets deepens, these vehicles could evolve into more influential liquidity channels.

Wider accessibility and improved transparency in ETF structures may ultimately attract deeper pools of capital, translating into more pronounced market impact. Until then, ETF flows are best read as one piece of a multifaceted puzzle rather than a definitive driver.

Bottom line: The $60 million in Ethereum ETF redemptions, set against the backdrop of ETH’s all-time high, highlights a market still defined by organic crypto-native demand rather than ETF-driven flows. For investors, the episode underscores the need to monitor ETFs in context — not in isolation — when mapping Ethereum’s evolving trajectory.