JP Morgan Owns Ethereum? Debunking the Biggest Myths About the Blockchain

From claims of centralization to JP Morgan supposedly owning it — does anyone still believe these myths?

The crypto world loves a good story, and Ethereum’s been at the center of some wild ones.

Whispers of deceitful founders, shadowy control by JPMorgan, rigged monetary policies, and censored transactions have fueled skepticism. But are these claims legit or just noise meant to mislead? Buckle up, because we’re diving deep to separate facts from lies.

Here’s what we’re unpacking:

Did Ethereum’s founders pull a fast one with the Proof-of-Stake switch?

Is JPMorgan secretly calling the shots on the network?

Are Ethereum’s monetary policies some arbitrary, manipulated mess?

Does Proof-of-Stake make Ethereum act like a central bank?

Are transactions really being censored by OFAC?

Was Ethereum’s ICO tainted by premining?

And those so-called “public recordings” against Ethereum — do they even exist?

There are only seven statements, and to debunk them all will require an entire article. That's how it works: a lie told in a single sentence demands a book full of truths in return.

1. Ethereum’s Proof-of-Stake Transition: A Transparent Triumph

Have you heard the claim that Ethereum’s founders pulled a fast one with their shift to Proof-of-Stake (PoS)? It’s a bold accusation.

Far from being a “lie” or deception, the transition to PoS, known as The Merge, was a masterclass in transparency, collaboration, and innovation. This wasn’t a sneaky move; it was one of the most ambitious upgrades in crypto history, built on years of open research, rigorous development, and lively community debate. Let’s set the record straight with the facts, showing why Ethereum’s journey to PoS is a testament to its strength and vision.

Historical and Documentary Evidence

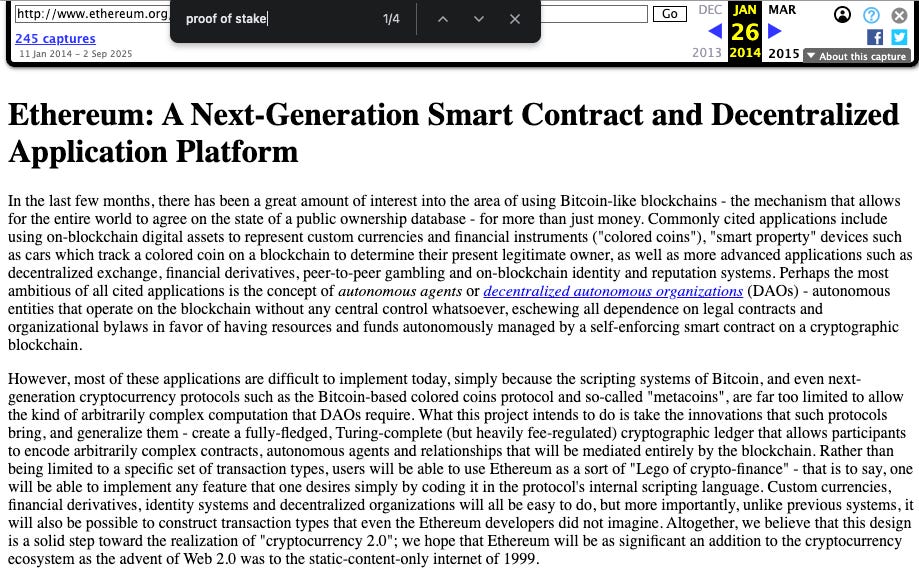

The idea of transitioning to a Proof-of-Stake (PoS) consensus mechanism dates back to Ethereum’s earliest days. Vitalik Buterin’s original whitepaper already highlighted PoS as valid mechanism. Yes, the first document ever published about Ethereum's architecture already mentioned PoS.

Other mentions about Proof-of-Stake are found in blog posts of Ethereum.org between 2014 and 2015:

While PoW powered Ethereum’s initial launch, its scalability limitations were well-known to the development community.

Ethereum’s roadmap, openly accessible and widely debated, always included PoS as a long-term goal. The transition was deliberately gradual, rolled out in phases to prioritize network security and stability. The Beacon Chain, launched in December 2020, marked the first step, letting users stake ETH and test PoS alongside the main PoW network. The final “Merge” on September 15, 2022, capped this multi-year journey, executed seamlessly with zero network downtime.

So, anyone saying that Ethereum's founders was hiding from the public the idea of using PoS on the blockchain is, at least, spreading misinformation.

If there's anything to criticize, it's whether the transition was flawless, transparent, and professional. Let's analyze that.

Technical Analysis of the Transition

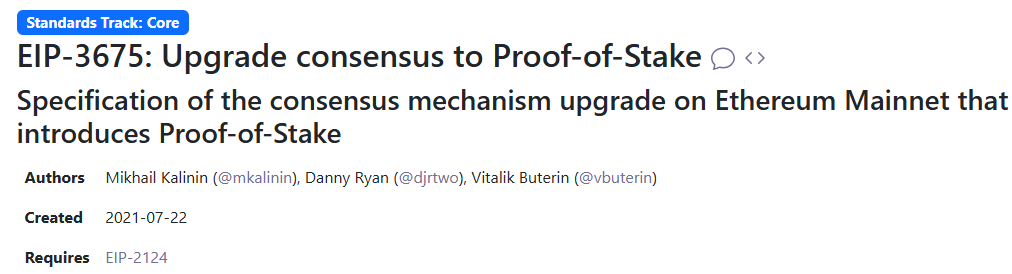

Ethereum’s transition to Proof-of-Stake wasn’t some quick code tweak — it was a massive engineering milestone backed by years of research and development. The Ethereum developer community published a wealth of research papers and Ethereum Improvement Proposals (EIPs) laying out the technical roadmap. Among them, EIP-3675 formally defined the move to PoS, and its adoption reflected overwhelming consensus across the community.

This transition wasn’t rushed. It went through a rigorous multi-stage testing process. Public testnets like Ropsten, Sepolia, and Goerli were used to simulate the Merge, stress-test the protocol, and iron out potential bugs long before mainnet implementation. This open and transparent approach gave developers and users worldwide the chance to participate directly, strengthening confidence in the upgrade.

Bottom line: the claim that Ethereum’s PoS transition was a “lie” doesn’t hold up. Ethereum’s documented history, its public roadmap, the breadth of technical research, and the transparent rollout all prove beyond doubt that PoS was a long-standing goal, achieved through collaboration and community-wide consensus. Anything else is a distortion of the facts, ignoring the mountain of public evidence.

Some might argue that migrating to PoS was a mistake. Well, there's room for debate on that point. But to claim that the transition was hidden or rushed is to demonstrate immense ignorance about how things work on a large blockchain like Ethereum.

2. Ethereum Is a Decentralized Network — and JPMorgan Doesn’t Control It

The claim that JPMorgan “owns” or “controls” Ethereum is factually wrong. It confuses the ownership of a private company with control over a decentralized blockchain network. This section breaks down why that narrative doesn’t hold, clarifying Ethereum’s decentralized design and untangling the relationships between JPMorgan, ConsenSys, and the broader Ethereum ecosystem.

The Decentralized Nature of Ethereum

By design, Ethereum is a decentralized network. That means no single entity — whether a corporation, a government, or an individual — controls it. The network is maintained by a global community of node operators, developers, and users who all play a role in its governance and operation. Protocol upgrades are decided through a consensus process involving a wide range of users, as outlined in the previous section.

Decentralization is one of Ethereum’s core features. It’s what gives the network resilience, security, and censorship resistance. No single party can unilaterally change the rules, roll back transactions, or block users from participating. This stands in stark contrast to traditional centralized systems, where a single authority holds complete control.

The Relationship Between JPMorgan, ConsenSys, and Ethereum

The rumor that JPMorgan controls Ethereum traces back to a business deal between JPMorgan and ConsenSys — a private software company that builds products and services for the Ethereum ecosystem. In 2020, JPMorgan acquired a minority stake in ConsenSys Software Inc. (CSI), the entity behind some of ConsenSys’ most widely used products, including the MetaMask wallet and the Infura infrastructure service.

It’s critical to understand that ConsenSys is not Ethereum. ConsenSys operates within the ecosystem, but the Ethereum network exists independently of it. MetaMask and Infura are popular tools that make it easier to interact with Ethereum, but they are not the network itself. Ethereum would continue to function without ConsenSys, without MetaMask, and without Infura. There are countless other wallets, nodes, and infrastructure providers available to developers and users worldwide.

JPMorgan’s stake in ConsenSys is an investment in a technology company — not in Ethereum itself. It gives the bank zero authority over the Ethereum protocol, its governance, or its monetary policy. Suggesting that JPMorgan “controls” Ethereum through this minority stake is a gross exaggeration and a distortion of the facts.

The R3 → Quorum → ConsenSys Trajectory

JPMorgan’s journey in the blockchain space is both revealing and often misunderstood.

R3 Consortium: Initially, JPMorgan was a member of the R3 consortium, which developed the Corda blockchain platform. But in April 2017, the bank left R3 to pursue its own blockchain initiatives.

Quorum Development: After leaving R3, JPMorgan developed its own blockchain platform called Quorum, built on Ethereum technology. Quorum was essentially a permissioned (private) version of Ethereum, designed for enterprise use. This choice shows that JPMorgan recognized the value of Ethereum’s architecture and decided to build on it — not control it.

Transfer to ConsenSys: In August 2020, JPMorgan handed off Quorum to ConsenSys, while also making a strategic, undisclosed investment in the company. This move marked the end of JPMorgan’s direct blockchain development efforts and its shift into the role of investor within the ecosystem.

Enterprise Ethereum Alliance (EEA)

JPMorgan was also a founding member of the Enterprise Ethereum Alliance (EEA), launched in February 2017. The EEA was created to connect Fortune 500 companies, startups, academics, and technology providers with Ethereum experts to accelerate enterprise adoption. Founding members included Microsoft, Accenture, Banco Santander, BNY Mellon, CME Group — and JPMorgan.

JPMorgan’s role in the EEA shows genuine interest in Ethereum as a platform for enterprise applications. But being a founding member of an industry alliance promoting Ethereum adoption is worlds apart from “controlling” the Ethereum network. The EEA is a standards and collaboration body, not a governance entity for the protocol.

The Bigger Picture

JPMorgan’s strategy can be seen as a natural evolution for a major financial institution exploring blockchain technology:

Initial Exploration: Membership in the R3 consortium to study blockchain.

Independent Development: Creation of Quorum, an Ethereum-based private chain.

Strategic Partnership: Transfer of Quorum to ConsenSys and pivot into a strategic investor role.

Implications for the “Control” Narrative

The historical context puts JPMorgan’s role into perspective and dismantles the control myth:

Its participation in the EEA was as a collaborative member, not as a controlling authority.

Building Quorum on Ethereum highlighted recognition of Ethereum’s value — not an attempt at domination.

Transferring Quorum to ConsenSys signaled JPMorgan’s exit from direct blockchain development.

Stating the obvious once again: its stake in ConsenSys is a minority investment in a private company, not ownership or control of the Ethereum network.

Taken together, this history makes it clear: claims that JPMorgan “controls” Ethereum are baseless. They rest on a flawed understanding of business partnerships and technology development in the blockchain space.

Contemporary Analogy: JPMorgan as a Service Provider

To better understand JPMorgan’s role in the Ethereum ecosystem, it helps to draw a parallel with companies operating in the space today. JPMorgan’s early involvement with Ethereum — through initiatives like Quorum and its stake in ConsenSys — is comparable to the role of infrastructure providers such as Alchemy, Infura or Etheralize.

Just like these modern companies:

They build on Ethereum: developing products, services, and infrastructure that make the network easier to use.

They don’t control the network: even if influential, they have no authority over the Ethereum protocol itself.

They depend on the network: their success is tied directly to Ethereum’s growth and adoption.

They contribute to the ecosystem: their innovations and services expand Ethereum’s utility and reach.

The takeaway is clear: being an active or even influential participant in the Ethereum ecosystem does not equal “controlling” the network. Just as no one today would claim that Alchemy or Etheralize control Ethereum, JPMorgan’s historical involvement did not amount to control over a decentralized protocol.

Governance and Control Analysis

A 2024 academic study from the University of Zurich examined Ethereum’s governance and concluded that, while there are areas of concentration, Ethereum’s governance is open, transparent, and not controlled by any single entity.

The study found that the Ethereum Foundation — a nonprofit organization that supports Ethereum’s development — plays an important role in coordinating and funding research and development, but it does not hold unilateral control over the protocol.

On-chain data further shows that ETH distribution and PoS validation are spread across a large number of participants. While some large staking pools exist, none hold a majority share capable of controlling the network. The Ethereum community is also actively working on solutions to enhance decentralization, such as liquid staking protocols and distributed validator technology.

3. Ethereum’s Monetary Policy Is Transparent, Predictable, and Community-Governed

The claim that Ethereum’s monetary policy is arbitrary or manipulated is a serious accusation — but it doesn’t stand up to scrutiny. In reality, Ethereum’s monetary policy, while it has evolved over time, is transparent, predictable, and guided by community consensus.

Since launch, Ethereum’s monetary policy has undergone changes. But these changes weren’t random — they emerged from a deliberate and transparent governance process aimed at strengthening the network’s security, sustainability, and economic soundness.

Transparency and Predictability

Ethereum’s monetary policy is fully transparent and predictable. The issuance of new ETH and the burning of transaction fees are governed by publicly known, auditable protocol rules. Anyone can verify the total ETH supply and the current inflation (or deflation) rate in real time using blockchain explorers and analytics tools.

Comparisons to a nation’s fiscal policy are misleading. Government fiscal policy is shaped by political, economic, and social factors, often opaque and subject to discretionary decisions by policymakers.

By contrast, Ethereum’s monetary policy is rule-based, consensus-driven, and transparent to all participants in the network.

Governance of Monetary Policy

Changes to Ethereum’s monetary policy are not dictated by a central authority. Instead, they are proposed, debated, and implemented through Ethereum’s governance process, which includes developers, node operators, ETH holders, and the wider community. Anyone can propose a change via an Ethereum Improvement Proposal (EIP), but no change takes effect unless it secures overwhelming community consensus.

This governance model ensures that monetary policy changes are carefully evaluated and serve the long-term health of the network. While the process can be slow and sometimes contentious, it guarantees that Ethereum’s monetary policy remains robust, secure, and aligned with the community’s goals.

There are many examples of Ethereum's governance protecting its decentralization, let's list some of them:

EIP-1559 — London (Aug 5, 2021)

Node readiness shortly before activation: >70% of nodes had upgraded two hours pre-fork (ethernodes snapshot). No chain split followed.

EIP-3675 — The Merge/Paris (Sep 15, 2022)

Consensus participation: Beacon Chain participation has typically been ~99%; analyses around the Merge show only a brief dip (~97.5%) that quickly reverted to 99%+ after, i.e., near-unanimous validator follow-through.

EIP-4844 — Dencun (Mar 13, 2024)

Consensus participation: Multiple industry write-ups put post-Dencun participation ~99%; one operator report flagged a temporary client/relay incompatibility that caused up to 13% missed proposals for a subset — not a network-wide split.

Timeline of Monetary Policy Changes

2015: 5 ETH per block (+ variable uncle rewards)

2017 (Byzantium): Reduced to 3 ETH per block

2019 (Constantinople): Further reduced to 2 ETH per block

2021 (London / EIP-1559): Introduction of base fee burning

2022 (The Merge): Full transition to dynamic PoS issuance model

2025 (Pectra): Increase in validator staking caps

This timeline shows that Ethereum’s monetary policy has evolved gradually, through community consensus and deliberate upgrades — not through arbitrary decisions.

Common Fallacy: The Difficulty Bomb as “Monetary Coercion”

Critics often point to Ethereum’s difficulty bomb as supposed evidence of a coercive mechanism to force monetary changes. But this argument is misleading and ignores Ethereum’s operational history.

The difficulty bomb — a mechanism that gradually increases mining difficulty until the network becomes impractical to use — has been delayed at least six times since 2017. It has never been allowed to take full effect. Upgrades such as Byzantium (2017), Constantinople (2019), and Muir Glacier (2020) consistently postponed its activation.

Most importantly, Ethereum’s actual monetary changes — block rewards dropping from 5 → 3 → 2 ETH — all happened before any real pressure from the difficulty bomb could materialize. These were community-driven governance decisions requiring broad consensus, not unilateral developer impositions.

PoW vs. PoS Governance

During the Proof-of-Work era (2015–2022), both difficulty bomb delays and monetary changes required genuine consensus across a globally distributed network of miners. In practice, the difficulty bomb acted more as theater — creating artificial urgency to coordinate upgrades — than as a real coercive tool in either context.

That’s why the claim that Ethereum’s monetary policy is arbitrary or manipulated doesn’t hold up.

Ethereum’s monetary policy is transparent, predictable, and governed through community consensus. Adjustments have been made to strengthen the network’s security and sustainability — ultimately turning ETH into a potentially deflationary asset. Comparisons to a nation’s fiscal policy are misleading, ignoring the fundamental difference between centralized decision-making and decentralized consensus.

4. Ethereum’s Proof-of-Stake Is a Decentralized Consensus Mechanism, Not a Central Bank

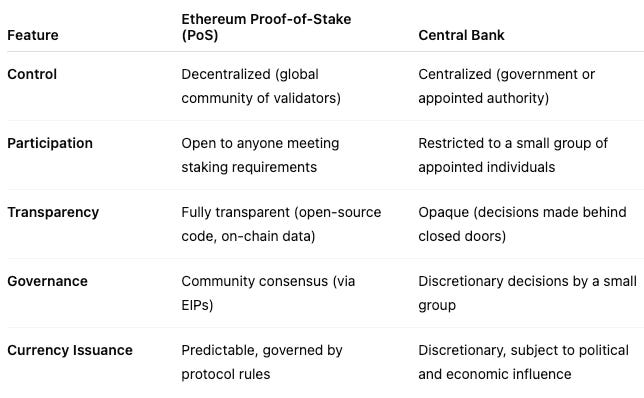

The claim that Ethereum’s Proof-of-Stake (PoS) system is comparable to a central bank is fundamentally flawed. It ignores the crucial differences between centralized institutions and decentralized protocols. This section breaks down why the analogy doesn’t hold, by explaining how Ethereum’s PoS works and highlighting the key contrasts with a central bank.

PoS is a consensus mechanism that allows a network of computers to agree on the state of a blockchain. In Ethereum’s PoS, participants — known as validators — deposit ETH as collateral to join the consensus process. Validators are then responsible for proposing and validating new blocks of transactions. If a validator acts dishonestly, their stake can be slashed (partially or fully confiscated).

Key features of Ethereum’s PoS that distinguish it from a Central Bank:

Decentralization: anyone can become a validator on the Ethereum network as long as they meet the staking requirements. There is no central authority deciding who can or cannot participate in consensus. The network is maintained by a global community of validators, making it resistant to censorship and control by any single entity.

Transparency: all of Ethereum’s PoS rules are open-source and publicly auditable. Anyone can inspect the code and verify that the system is functioning as intended. By contrast, central bank operations are often opaque and far from fully transparent to the public.

Community Governance: changes to Ethereum’s PoS protocol are made through a community-driven consensus process, as explained in previous sections. Validation today is carried out by more than 900,000 independent validators, with no single entity holding an absolute majority. Even the largest share — Lido at ~31% — still relies on a set of independent operators. No central authority can unilaterally change the rules. By contrast, central bank decisions are made by a small group of government-appointed officials.

Comparative Analysis with a Central Bank

The table below highlights the key differences between Ethereum’s Proof-of-Stake (PoS) and a central bank:

The claim that Ethereum’s PoS is “like a central bank” is a false analogy that ignores the fundamental differences between decentralized and centralized systems.

Ethereum’s PoS is an open, transparent, community-governed consensus mechanism, designed to resist control by any single entity.

While challenges related to centralization do exist, the Ethereum community is actively working to address them, ensuring the network remains decentralized and secure for the long term.

Generally, some claim Ethereum is “centralized” simply because it is less decentralized than Bitcoin. Decentralization exists on a spectrum; being less decentralized than another blockchain does not make a network centralized. That’s flawed logic.

5. The Reality of OFAC Censorship

OFAC compliance on Ethereum operates through the MEV-Boost protocol, where block builders may choose to filter transactions from sanctioned addresses. Crucially, this filtering is neither mandatory nor universal. Validators remain free to propose blocks without using MEV-Boost, or to select builders that do not enforce OFAC filters.

(OFAC = Office of Foreign Assets Control, a U.S. Treasury Department agency that administers and enforces economic and trade sanctions.)

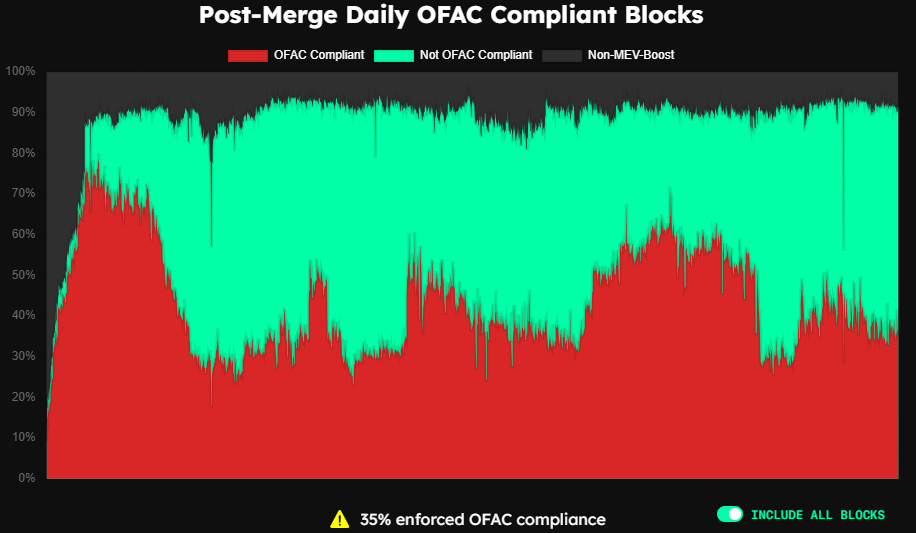

According to MEV Watch, OFAC compliance has shown significant volatility since the Merge:

Peak: 79% of blocks were OFAC-compliant in late 2022

Sharp Decline: Dropped to around 27% by January 2024

Current State: Fluctuating between 25–35% compliance

This temporal variability demonstrates that OFAC compliance is a dynamic choice made by network participants — not an automatic, systemic imposition. During periods of heightened concern over censorship (notably after the Tornado Cash sanctions), validators actively opted for “non-censoring” builders.

No major blockchain network operates with 0% regulatory compliance. Bitcoin, for example, has mining pools that implement similar filtering (see image above), and other PoS networks display geographic concentrations that are comparable — or even higher. The difference is that Ethereum’s OFAC compliance is transparent and measurable through tools like MEV Watch.

Concerns about U.S. jurisdiction are legitimate, but operational data shows that jurisdiction does not automatically translate into active censorship. The swing in OFAC compliance — from 79% down to 27% — demonstrates that the network retains functional censorship resistance, operating through economic incentives and community pressure rather than absolute technical imposition.

6. Ethereum’s Alleged “Massive and Unfair Premine”

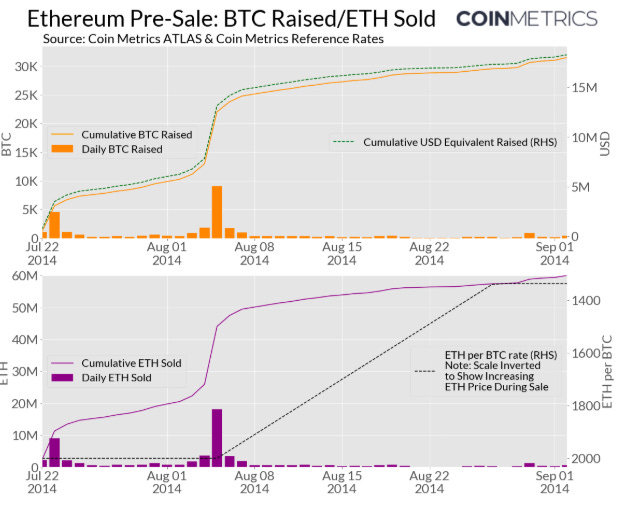

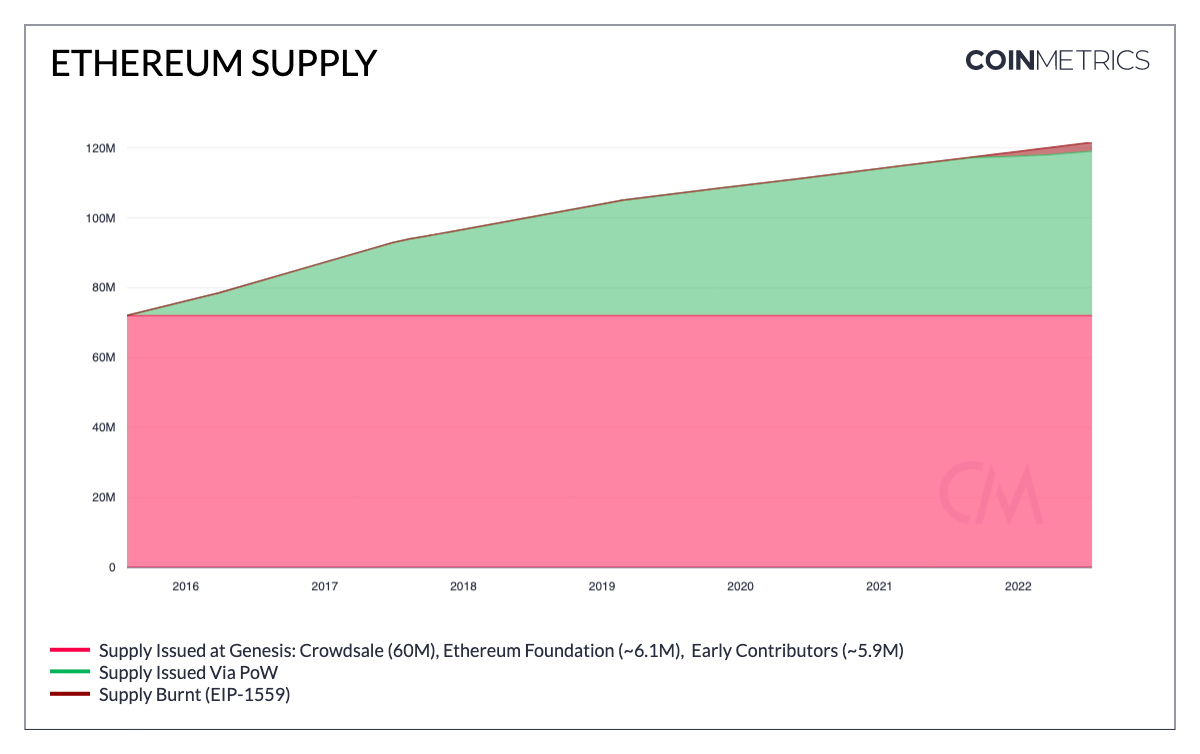

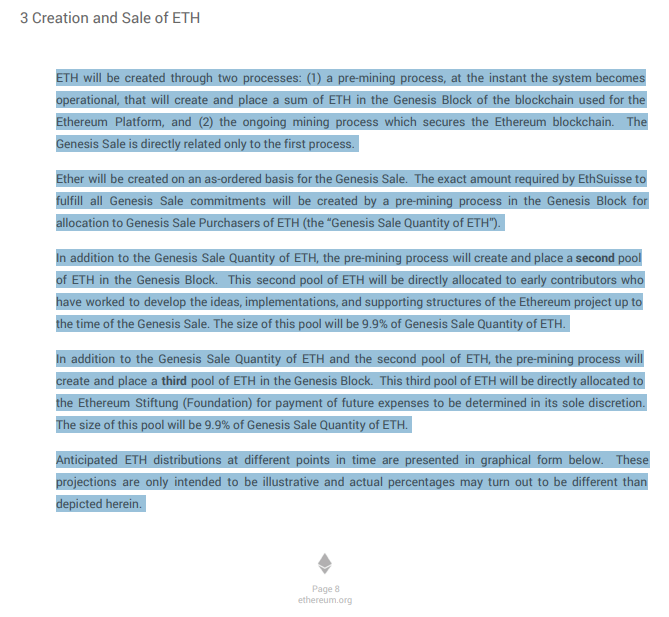

This allegation deserves factual acknowledgment followed by rigorous context. Yes — Ethereum implemented a premine of 72 million ETH in its genesis block, which today represents roughly 65% of the circulating supply.

That initial allocation was divided as follows:

60 million ETH (83.47%) were sold publicly through an ICO.

12 million ETH (16.53%) were allocated to the founders and the Ethereum Foundation.

Of the 60 million ETH sold, about 50 million were purchased within the first two weeks, when the price was significantly discounted — with major volume spikes at the start of the sale and on the final day of the 2,000 ETH per BTC rate.

More than 92% of Ethereum’s genesis accounts have already moved their ETH, leaving only about 680 accounts that have never transferred their allocation.

In total, the accounts created at Ethereum’s genesis now control less than 2% of the total ETH supply.

Unlike projects that hid their premines, Ethereum publicly documented its entire initial distribution.

And unlike Bitcoin — which Satoshi Nakamoto could launch with a simple announcement and an open-source code release — Ethereum required massive funding to build out complex infrastructure: the Solidity programming language, the Ethereum Virtual Machine, the smart contract system, and developer tooling. The premine served as a necessary funding mechanism to create an ecosystem that went far beyond simple peer-to-peer transfers.

7. Alleged Public Recordings of Founders “Admitting Lies” About PoS

The fundamental claim that there are “public recordings of Ethereum’s founders admitting lies about Proof-of-Stake (PoS)” is entirely unsupported by verifiable evidence. The only so-called “recording” critics point to comes from Steven Nerayoff, a former advisor to Ethereum.

When Nerayoff finally released his long-hyped “explosive evidence” in November 2023, what surfaced was a 2015 conversation between him and Vitalik Buterin. The content of the recording was, in fact, a technical discussion about Ethereum’s direction — and contained no admission of fraud or criminal wrongdoing.

Nerayoff accused Buterin and other Ethereum leaders of mismanagement, highlighting issues such as failing to hedge Bitcoin reserves, poor financial planning, and serious regulatory risks related to securities laws, taxation, and money transmission. In recorded conversations, he advised Buterin to radically restructure the project: dismiss most of the leadership, conduct an independent audit, and form a new for-profit entity backed by venture capital. In later years, Nerayoff escalated his allegations, suggesting that Vitalik and Ethereum benefited from regulatory favoritism (“ETHGate”) and even framed the entire Web3 ecosystem as a tool for fraud and personal enrichment.

Despite the dramatic claims, none of Nerayoff’s most serious accusations — fraud, corruption, or collusion with regulators — have been proven in court or by independent investigation. The recordings confirm that Nerayoff did, in fact, give Vitalik detailed legal and financial warnings, but there is no public evidence that these recommendations were ever executed. To date, his warnings remain historical anecdotes rather than validated scandals, and Ethereum’s development path diverged significantly from the rescue plan he outlined.

A decisive point undermining the credibility of the fraud narrative is Nerayoff’s own public admission: “the recording is not directly related to fraud, but it will shed light on much of what was happening.” This is a clear acknowledgment that the material he presented does not constitute direct proof of the conspiratorial claims he had been promoting.

The "revealing conversation" only serves to show how Ethereum, in its early days, faced the same challenges that every large enterprise faces: money, people, and processes.

Based on verified evidence, Nerayoff’s narrative, while sensationalist, lacks any direct factual support — meaning there are, in truth, no such recordings proving fraud.

Conclusion

After examining the evidence, the conspiratorial claims against Ethereum collapse into a systematic exercise in bad-faith argumentation. Steven Nerayoff, a central figure in these theories, publicly admitted that his so-called “explosive evidence” proves no fraud at all — a confession that should embarrass anyone who promoted his allegations as fact.

The inability to distinguish between JPMorgan’s minority investment in a private company and control over a decentralized network reveals a shallow and misleading grasp of both markets and technology.

Equating Ethereum’s transparent, consensus-driven monetary changes with the opaque fiscal maneuvers of governments is intellectually dishonest. More than 900,000 independent validators are conveniently reduced to “centralization” in conspiratorial narratives, while empirical data — such as OFAC compliance dropping from 79% to 27% — is ignored when it doesn’t fit the script.

The line between legitimate criticism and conspiracy is crystal clear: critics present evidence and revise when proven wrong; conspiracists cling to fantasies even after they’ve been refuted.

As we early said, spitting out lies is always easier than serving the truth.